OK. You'll have to forgive me. This one is really because I was just curious of what the chart looks like. Why? I'm not sure. It's certainly not a fundamental analysis of anything, and I would be wrong to say you should read well, anything, into it.

On the other hand, somehow this chart is an attempt to answer questions as profound as

--Is Bitcoin a fraud?

--Is Facebook evil?

--If Bitcoin is a fraud, and Facebook is evil, what do we do now?

And other less important questions like

--Where are we at in the installation > deployment continuum of technological revolutions with regards to cryptocurrencies? What about with regard to 21st century software companies?

--Have we started to see one technological paradigm start to replace another?

--Have we seen financial capital decouple from productive capital in the context of software (or crypto)? Are we in bubble territory?

--If we are in a bubble territory, which is a bigger bubble? Open-source digitally-native money that has no cash flows or software companies trading at >20x earnings?

OK enough of that, can't think too hard here. Let's pull and normalize (grr Bitcoins trade on weekends and NASDAQs don't) the data, dig into the numbers, and look at some charts.

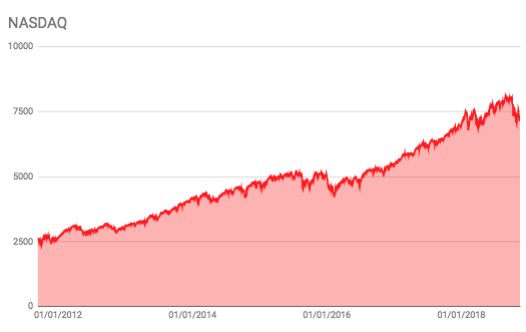

First off, this is what NASDAQ has done since Sep 13, 2011 (I started there because it was the furthest back I could find good BTC daily close data for). Basically it's had a steady grind higher for the last 7+ years, essentially tripling in value from ±2,500 to ±7,500, with recent turbulence bringing it down to ±7,200 (from an all-time high of ±8,000)

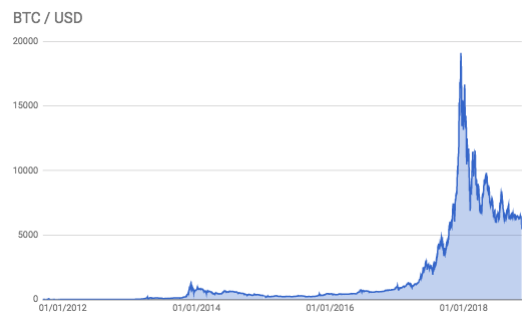

Secondly, this is what Bitcoin has done since Sep 13, 2011. It was basically worth nothing for a long time, and then it was worth very little until the end of 2013 when it became worth quite a lot quite quickly. And then it became worth relatively little again. And then over the course of 2017 it grew to be worth what many people now consider to be an absurd amount (±$20,000), and today people think that ±30% of that absurd amount sounds like the right number.

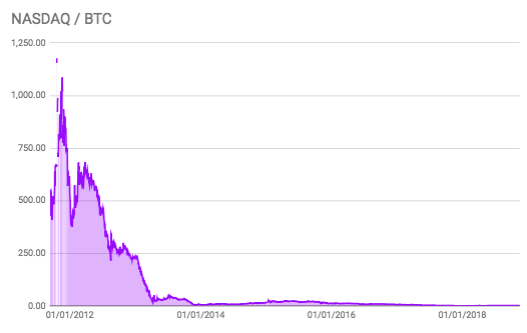

Finally, we turn to the question of how many Bitcoins a NASDAQ costs:

OK this first one isn't super helpful. From this perspective it's clear that a NASDAQ at one point cost a lot of Bitcoins and then later it's price appears to have collapsed (in terms of Bitcoins). In Oct 2011 in fact it would have taken 1,177 Bitcoins to buy a NASDAQ. And today you can buy a whole NASDAQ for only 1.31 Bitcoins. From this perspective it is fair to say that the NASDAQ looks really cheap on a long-term horizon (in terms of Bitcoins).

What if we zoom in?

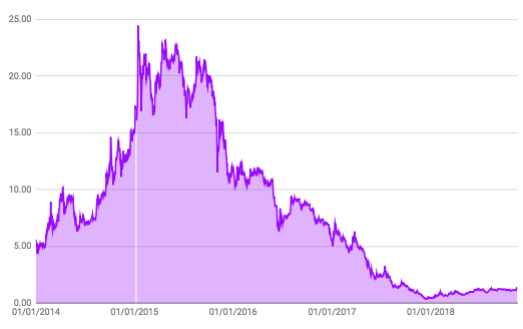

This next chart shows us how many Bitcoins a NASDAQ has cost since Jan 1, 2014 (after that period in 2013 after Bitcoins became worth quite a lot quite quickly). This is a more interesting chart with probably 4 distinct phases.

(i) In the first phase, from Jan 1, 2014 to Jan 14, 2015, NASDAQs became 5x more expensive (in terms of Bitcoins) going from 5 BTC (Bitcoins) to 25 Bitcoins.

(ii) In the second phase, from Jan 2015 to Sep 2015, NASDAQs were bouncing up and down around 20 Bitcoins.

(iii) In the third phase, from Sep 16, 2015 to Dec 17, 2017 NASDAQ went into a complete free fall. You might have missed this in the headlines. On September 16, 2015 a NASDAQ would have cost you 21.48 BTC. Just two years and three months later, that same NASDAQ would only have been worth 0.36 BTC (an all time low), losing 98.3% of its value in terms of Bitcoin in the process.

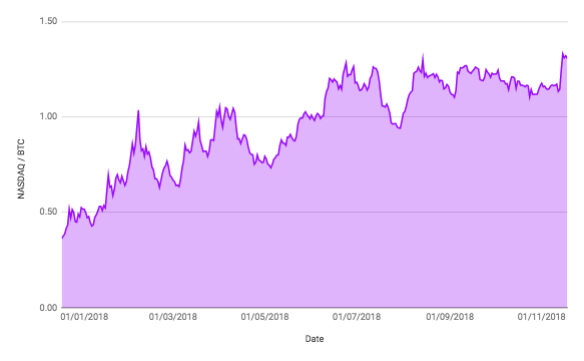

(iv) The fourth phase spans from Dec 17, 2017 through to today and may also be of interest. Folks will often try and tell you that 2018 has been an unususal post GFC year in that asset prices across indices like NASDAQ have sagged (actually NASDAQ is up ±5% in USD terms through Nov 16, 2018). Crypto investors however might look at NASDAQ and see tremendous performance! NASDAQ is +153% YTD in Bitcoin terms!

Here's a chart dedicated just for the fourth phase

Conclusion?

Likely nothing of value to take away here